View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=8c3a3f1f_2)

.jpg?sfvrsn=8c3a3f1f_2)

An Open-ended dynamic debt scheme investing across duration.

Credit Quality: Investing predominantly in State Development Loan (SDL) and AAA PSU papers in almost equal proportion (~50% each)

Duration: Invest in papers with maturity of approximately 5 years (+/- 6 Months), which in current scenario is the sweet spot.

Approach: It will follow accrual rolldown strategy which has potential to work well in current interest rate scenario.

An Open-ended dynamic debt scheme investing across duration. A relatively high interest rate risk and relatively high credit risk.

Mr. Basant Bafna

24th March, 2017

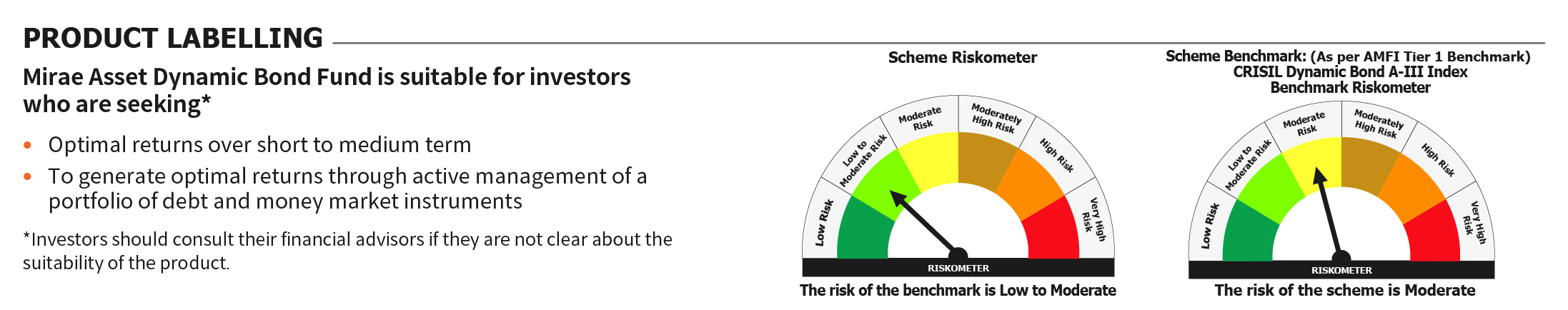

Tier-1 - CRISIL Dynamic Bond A-III Index

Tier-2 - Nifty PSU Bond Plus SDL Apr 2027 50:50 Index

₹ 5,000/- and in multiples of ₹ 1/-thereafter.

₹ 1,000/- per application and in multiples of ₹ 1/- thereafter.

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

Click here to view

Click here to view the latest TER.

Recommended Investment Horizon

3+ Years

Investment in high quality papers with flexibility to invest

Income

For Historic NAV Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

For Historic Dividend Click here

Mirae Asset Debt Investment Process and Philosophy

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | C- III |

| Name | Allocation | |

| CORPORATE BOND | ||

| 1 | REC Limited | 8.46% |

| 2 | National Bank For Agriculture and Rural Development | 8.27% |

| 3 | Indian Railway Finance Corporation Limited | 7.43% |

| STATE GOVERNMENT BOND | ||

| 1 | 7.85% Rajasthan SDL (MD 15/03/2027) | 10.56% |

| 2 | 7.86% Karnataka SDL (MD 15/03/2027) | 9.27% |

| 3 | 7.76% Madhya Pradesh SDL (MD 01/03/2027) | 9.22% |

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.