View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=bdec1266_2)

.jpg?sfvrsn=bdec1266_2)

An open ended equity scheme investing in healthcare and allied sectors

The scheme has atleast 80% investments in Pharma, Healthcare and allied sectors.

Healthcare is an evolving theme which has tremendous growth potential and includes businesses in hospitals, diagnostics, specialty chemicals, medical equipment, insurance and other allied sub sectors.

The endeavor is to maintain a concentrated portfolio of 30-40 stocks in this theme.

Fund has the flexibility to invest across market capitalization and style in selecting investment opportunities within this theme.

Sectoral/Thematic Fund - An open ended equity scheme investing in healthcare and allied sectors

Mr. Vrijesh Kasera - since (02nd July, 2018)

Mr. Tanmay Mehta - since (1st April 2025)

2nd July, 2018

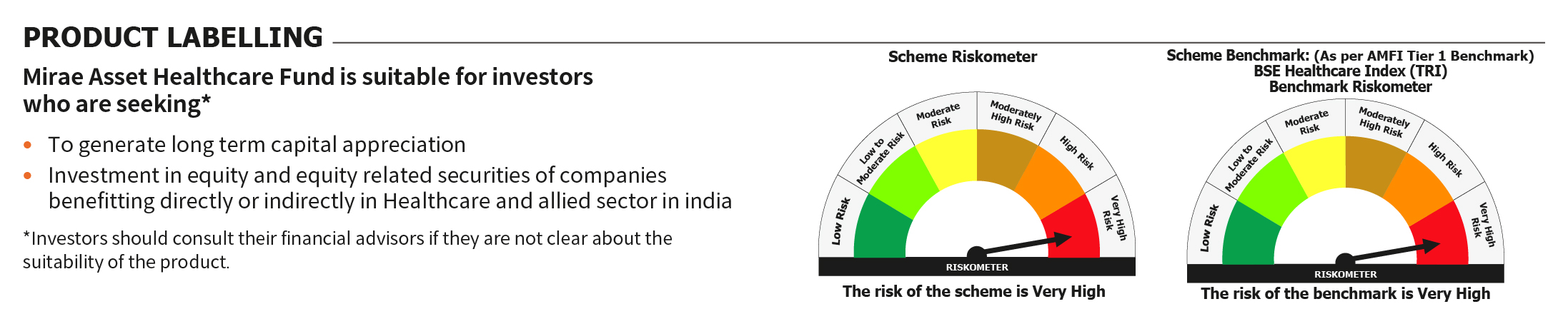

BSE Healthcare Index (TRI)

Rs. 99 & in multiples of Re. 1 thereafter

Rs.500 & in multiples of Re. 1 thereafter

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

Recommended Investment Horizon

5+Years

Investments in Healthcare and allied sectors.

Wealth Creation

For Historic NAV Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

For Historic Dividend Click here

Mirae Asset Equity Investment Process and Philosophy

Since 2nd July 2018

.jpg?)

Since 1st April 2025

28

45

92

| Name | Allocation |

73.13%

73.13%

18.51%

18.51%

3.94%

3.94%

4.35%

4.35%

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.