View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=8799adcf_2)

.jpg?sfvrsn=8799adcf_2)

The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity related securities of mid cap companies. From time to time, the fund manager may also participate in other Indian equities and equity related securities for optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized

Invest predominantly (>65%) in to Mid-Cap equity and equity related instruments (101st -250th company in terms of full market capitalization). The fund may also participate in other Indian equities based on factors like relative valuations, liquidity and market sentiments

Aim to build a portfolio of companies having robust business models which have the potential to grow into tomorrow’s large caps.

Diversified portfolio with participation across sectors

The universe of stocks will comprise majorly of companies having robust business models, enjoying sustainable competitive advantages as compared to their competitors and have high return ratios.

The Fund Manager will endevour to create a robust portfolio to avoid concentration risk and liquidity risk. The Fund Managers will monitor the trading volumes in a particular stock before investment to avoid liquidity risk.

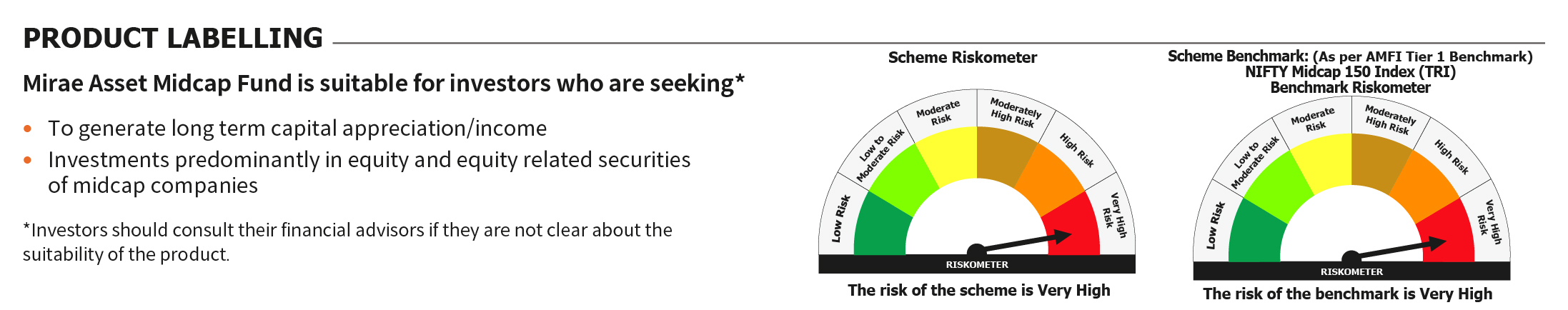

An open ended equity scheme predominately investing in mid cap stocks

Mr. Ankit Jain (Since inception)

29th July, 2019

NIFTY Midcap 150 (TRI)

Rs. 99 & in multiples of Re. 1 thereafter

₹ 1,000/- per application and in multiples of ₹ 1/- thereafter.

Regular and Direct Plan

Click here to View

Growth Option and IDCW (Payout / Reinvestment)

Click here to View

click here to view

Click here to view the latest TER.

53

17

52

| Name | Asset |

11.48%

11.48%

10.05%

10.05%

7.34%

7.34%

6.68%

6.68%

6.15%

6.15%

5.98%

5.98%

5.25%

5.25%

5.13%

5.13%

4.00%

4.00%

3.74%

3.74%

33.92%

33.92%

*Data as on 31st March, 2022.

Click here to download the Policy on disclosure of Risk Parameters

View NowOur representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.