View Performance of the funds managed by the Fund Manager

An open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF

An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF

Ms. Ekta Gala

Mr. Akshay Udeshi

10th May 2021

Rs. 10/-

Rs.500 & in multiples of Re. 1 thereafter

Regular Plan and Direct Plan with Growth Option

Click here to View

Click here to view the latest TER.

Investors may note that they will bear recurring expenses of the underlying scheme in addition to the expenses of this scheme.

Recommended Investment Horizon

3+ Years

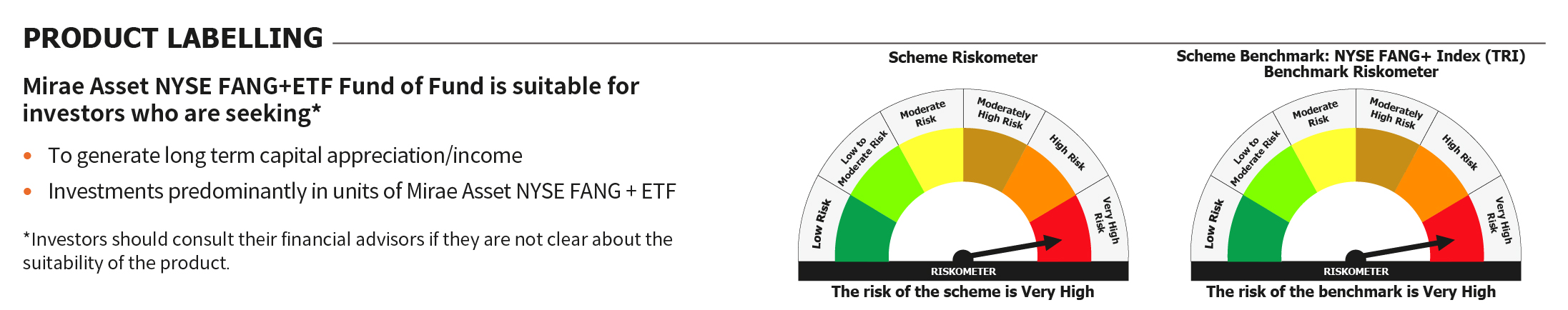

the scheme will predominantly invest in units of Mirae Asset NYSE FANG+ ETF, the portfolio of which shall mostly be based on stocks forming part of NYSE FANG+ Index.

Provides the advantage of investing in Exchange Traded Funds through Mutual Fund route.

For Historic NAV Click here

| Name | Allocation | |

| 1 | Mirae Asset Mutual Fund | 99.95% |

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.