View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=cf717c9a_2)

Mirae Asset Arbitrage

Fund

About the fund

Aiming to capture risk free profit

The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivative segments of the equity markets and the arbitrage

opportunities available within the derivative segment and by investing the balance in debt and money market instruments.

There is no assurance or guarantee that the investment objective of the scheme will be

realized.

INVESTMENT FRAMEWORK

Invest predominantly in completely hedged arbitrage opportunities (simultaneous transactions of a long position in cash and exactly short position in futures)

A small portion will be invested in other arbitrage opportunities (corporate action driven, event driven)

Aims to provide relatively risk-free returns without taking any directional equity risk

If arbitrage opportunities are limited, the scheme may invest a small portion in high quality low duration debt securities or money market instruments

The margin money requirement for the purposes of derivative exposure will be held in the form of Term Deposits, Cash or Cash equivalents.

Fund facts

Type of Scheme

An open ended scheme investing in arbitrage opportunities

fund manager

Mr. Jignesh Rao (Equity Portion) - (Since 19th June, 2020)

Mr. Jigar Shethia (Equity Portion)-(Since 19th June, 2020)

Mr. Krishnpal Yadav

benchmark index

NIFTY 50 Arbitrage Index

Minimum SIP Installment Amount

Rs. 99 & in multiples of Re. 1 thereafter

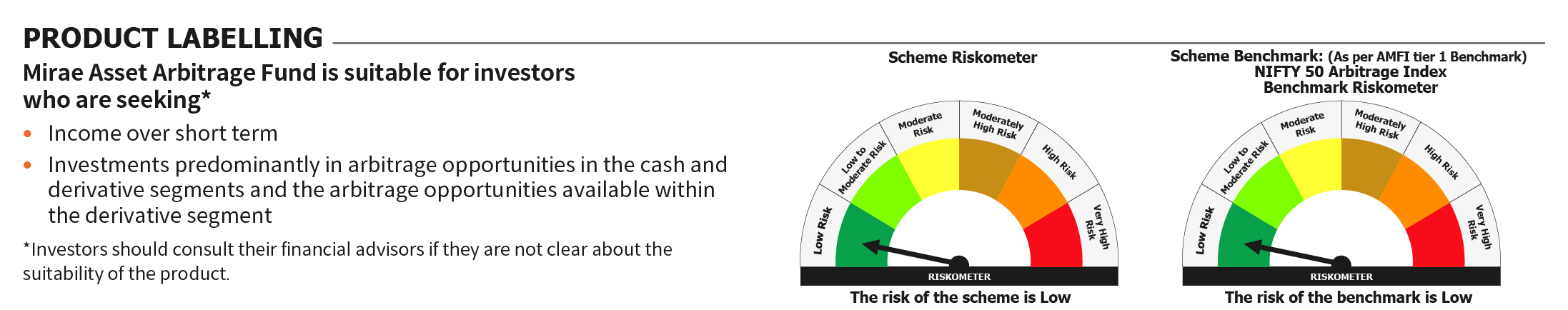

Risk:

Low Risk

plans available

Regular Plan and Direct Plan

options available

Growth Option and IDCW (Payout / Reinvestment)

Taxation

Click here to View

TER ( Total Expense Ratio)

Click here to view the latest TER.

Ideal Investment Horizon

Aim to take advantage of price inefficiencies in different markets

Regular Income

Net asset value

For Historic NAV Click here

Arbitrage Fund FAQs

The concept underlying arbitrage funds is simple - buying something at a lower price in one market and selling it at a higher price in another market both simultaneously to pocket profit. These funds ride on market inefficiencies with an aim to reap benefits for the investors.

The fund predominantly invests in cash and future markets (equity) with some allocation in fixed income instruments spreading across fixed deposits and balance in cash & short-term debt instruments. On an average the fund would usually allocate 65% + in arbitrage (65-75%), 10% -25% in Fixed deposits (for margin money for derivative trades) and 0-10% in debt and money market instruments (mainly TREPS).

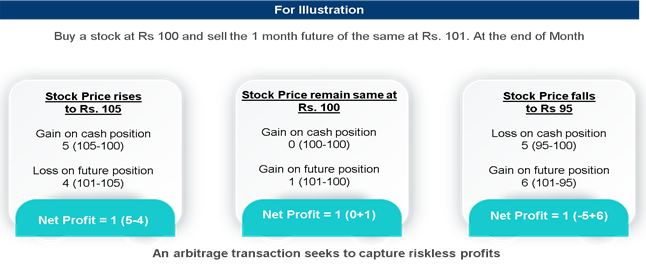

Arbitrage is simultaneous buying and selling the same underlying security or its derivatives in different market segments to make risk free profits.

Most commonly arbitrage fund uses cash and carry arbitrage (price differential between cash and future market). The Index and basket of stocks arbitrage (price differential between Index and basket of stocks constituting Index), exchange arbitrage (price differential among two exchanges) are rarely used.

Sometimes arbitrage funds also takes advantage of price differential created by corporate events such as Merger and Acquisitions (M&A), Buy backs, Rights issue etc. However, these opportunities are very rare. Also, they need to be executed properly to ensure that the trades are rightly executed.

Price of the same security is different in two stock exchanges e.g. share of a company is trading at Rs 100 in NSE and Rs 101 in BSE. You can lock-in Rs 1 profit / share by simultaneously buying it in NSE and selling it in BSE.

Cash and carry arbitrage is the most common arbitrage strategy used by arbitrage mutual funds. This strategy takes simultaneously position in one stock in cash and future market. The fund buys in cash market and sells in future markets The primary objective of this is to lock in spread available between these two markets.

For Example : Price of the share of a company in the cash market is Rs 1785 and price of the current series future of the same company in the Futures and Options (F&O) market is Rs 1794. You can lock-in Rs 9 profit / share by simultaneously buying the share in cash market and selling it in the future market.

This is essentially same as cash and carry arbitrage ‒ the only difference is that instead of a single stock here the arbitrage is for the index.

For example, Nifty is trading at Rs 9,300 in the F&O market whereas equivalent price of a basket of stocks constituting Nifty (in the same proportion as the index) is Rs 9275 in the cash market. You can lock-in Rs 25 profit per Nifty future contract by simultaneously selling Nifty and buying the basket of stocks in the cash market.

Arbitrage funds are relatively safe, and carry little risk. The risk of equities is reduced by hedging against the derivatives. However, there are certain inherent risk attached to arbitrage strategies and factors like lack of arbitrage opportunities, their perfect execution and the liquidity in the stock/cash and futures segments are some of the factors that can contribute to the uncertainty & risk.

If you invest in low rated debt instruments, there are some risks like default risk and rating downgrade risks.

Yes, arbitrage fund returns at times can be volatile or post a negative return on a single day due to mark to market losses. This mark to mark (MTM) loss can happen in both in equity and debt portion.

The marked to market valuation of equity portion of the portfolio happens daily till the expiry date. This valuation is benchmarked against the locked in yield / rollover yield of the portfolio which in turn decides the return for the day. So even if market has gone up / gone down on a single day, the portfolio movement can be opposite till the existing positions are closed and new rollover yield is locked into. from the previous level of locked in yield of the portfolio.

There can be volatility or negative returns due to debt portions as well because of MTM and higher duration paper.

The above scenarios can drive arbitrage fund to post a negative return. However, one single day return can be outlier and may not be worthwhile to measure fund’s consistency over a period time.

Tax advantage is a great plus for arbitrage funds. When the equity holdings in the cash market are held over and above 65%, these schemes are considered as equity funds. The equity orientation of the fund gives an edge over debt and liquid investment options. .

While profits made in debt funds held for less than 36 months is taxed as per the income tax rate of the investors, profits made in arbitrage funds held for less than 12 months (short term capital gains) is taxed at 15% plus applicable surcharge and cess. If units of arbitrage funds are sold after 12 months from date of purchase then profits (long term capital gains) of up to Rs 1 lakh are tax exempt in a financial year. Long term capital gains in excess of Rs 1 lakh are taxed at 10% only.

For Instance

Short Term capital gain Taxation

| Details | Arbitrage Fund | Debt Funds |

|---|---|---|

| Amount Invested | 1,00,000 | 1,00,000 |

| Returns in 6 Months (assumed) | 3.50% | 3.50% |

| returns in amount in 6 months | 3,500 | 3,500 |

| Tax rate (short Term) | 15.60% | 31.20%* |

| Tax in Amount | 546 | 1,092 |

| Net gain post Tax | 2,954 | 2,408 |

| Returns post tax | 5.99% | 4.88% |

Long Term capital gain Taxation#

| Details | Arbitrage Fund | Debt Funds |

|---|---|---|

| Amount Invested | 1,00,000 | 1,00,000 |

| Returns after 12 Months (assumed) | 7.50% | 7.50% |

| returns in amount after 12 months | 7,500 | 7,500 |

| Tax rate (Long Term) | 10.40% | 31.20%*# |

| Tax in Amount | 780 | 2,340 |

| Net gain post Tax | 6,720 | 5,160 |

| Returns post tax | 6.72% | 5.16% |

Note: This is only for illustration purpose. Surcharge, if applicable, considering the category and income of the investor may also be payable. * Tax rates assumed for individuals/HUFs are for highest Tax bracket as on 31st May, 2020.The rate for resident individuals & HUFs is 20.80 % including cess for long term capital gains. STT is also payable over and above capital gains tax, as per applicable rates for Equity Oriented Funds Rates mentioned may be subject to MAT also. Please consult your financial and tax advisor and read and understand the concerned Scheme Information Document and the SAI before arriving at any investment decision. #Long term period for other than Equity Fund is more than 36 months.

The margin money is required for taking arbitrage position (i.e. future positions) in the market. Generally, it is kept in the form of short-term deposits, cash or cash equivalents as per the regulations. Fund have to maintain enough balance to maintain that account on daily basis. At the end of each trading day, the margin account is adjusted to reflect gain or loss depending upon the future closing price.

An investor should check from SID that fund mandate is to run 100% fully hedged equity portfolio and quality of fixed income portfolio in terms of Credit and Duration risk.

Mirae Asset Equity Investment Process and Philosophy

Returns with asset class

Holdings

| Name | Allocation | |

| Equity Holdings | ||

| 1 | Adani Ports and Special Economic Zone Limited | 4.40% |

| 2 | Reliance Industries Limited | 3.98% |

| 3 | Bharti Airtel Limited | 3.86% |

| 4 | Sun TV Network Limited | 3.79% |

| 5 | Bandhan Bank Limited | 3.35% |

| 6 | Infosys Limited | 2.78% |

| 7 | Kotak Mahindra Bank Limited | 2.69% |

| 8 | ITC Limited | 2.61% |

| 9 | Hero MotoCorp Limited | 2.33% |

| 6 | Vedanta Limited | 2.30% |

| 11 | Others | 38.85% |

Allocation

9.28%

9.28% 8.21%

8.21% 5.85%

5.85% 5.26%

5.26% 4.94%

4.94% 4.40%

4.40% 3.98%

3.98% 3.44%

3.44% 3.39%

3.39% 2.73%

2.73% 19.46%

19.46%Sector allocation historic

Diversified: flexibility to invest across sectors, themes & stylesAsset Allocation

Rating Profile

*Data as on 31st March, 2022.

Downloads

Videos

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for submitting your request

Our representative will get in touch with you shortly.

Our Calculation Formula

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Our Calculation Formula

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

Redirecting...

Thank you sharing your details.

We will email you the cobranding collateral shortly.