View Performance of the funds managed by the Fund Manager

China

China

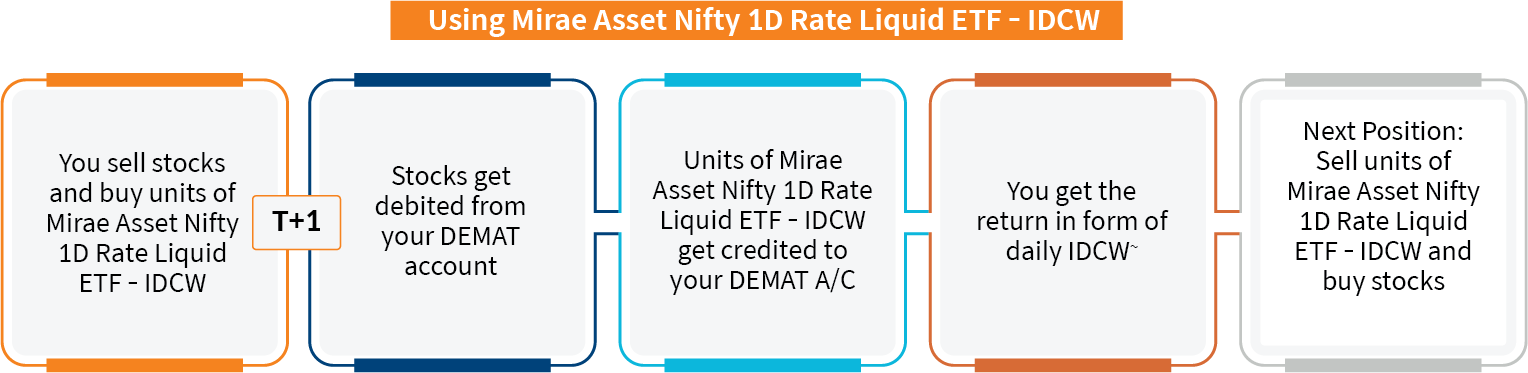

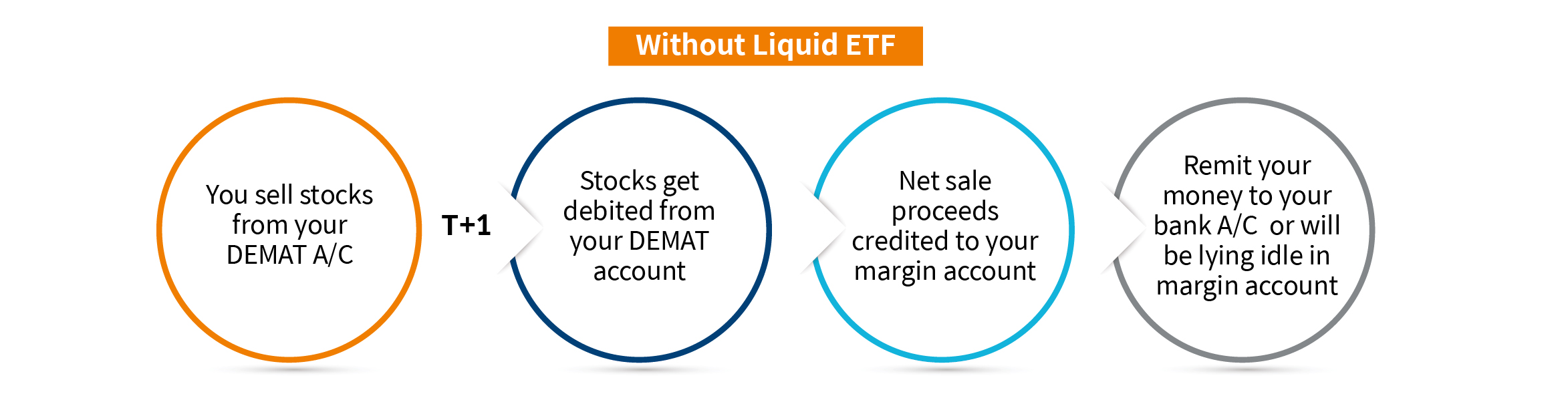

Graphical representation is only for the understanding of normal market settlement practice. Special events like market holiday, merged settlement dates, short payin-payout, close out etc. are not considered for simplicity. This settlement is applicable only for Individual (non-institutional) Investors. The illustration is based on the assumption that you have provided the consent to keep your funds on running account basis in margin account you hold with your broker. ~ Please note that the scheme will declare IDCW at a daily frequency, subject to availability of distributable surplus.

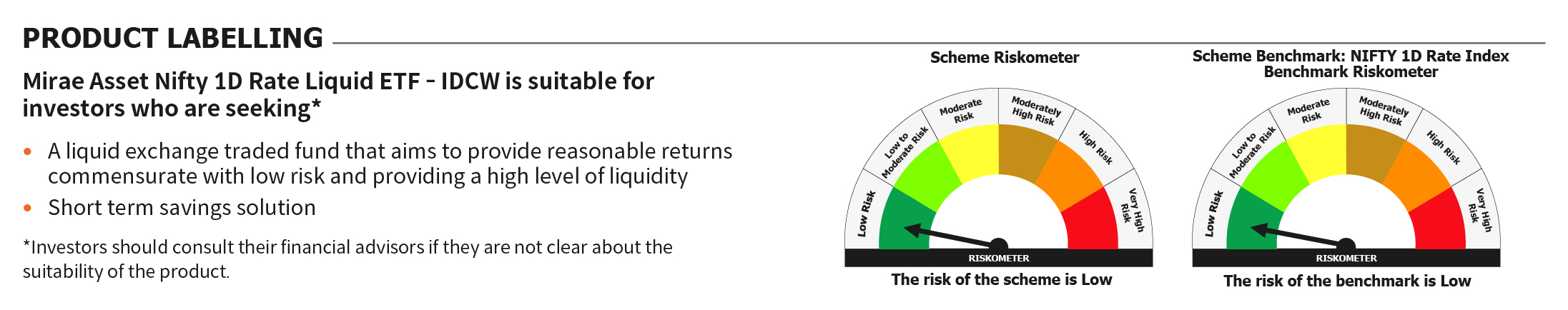

The investment objective is to seek to provide current income, commensurate with low risk while providing a high level of liquidity through a portfolio of Tri-Party Repo on Government Securities or T-bills / Repo & Reverse Repo. The Scheme endeavours to provide returns that before expenses, closely correspond to the returns of Nifty 1D Rate Index subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns.

*Dividends mentioned over here imply dividends. IDCW is abbreviation of Income Distribution cum Capital Withdrawal. Calculation of eligible IDCW will start from the day, Mirae Asset Nifty 1D Rate Liquid ETF-IDCW is credited to your Demat Account. Eligible IDCW declared is compulsorily reinvested into , Mirae Asset Nifty 1D Rate Liquid ETF - IDCW and the additional units arising out of investment of such IDCW will be credited to your Demat account. Please note that the scheme will declare IDCW at a daily frequency, subject to availability of distributable surplus.

An open-ended listed liquid scheme in the form of an Exchange Traded Fund tracking Nifty 1D Rate Index, with daily Income Distribution cum capital withdrawal (IDCW) and compulsory Reinvestment of IDCW option. A relatively low interest rate risk and relatively low credit risk

Mr. Krishnpal Yadav

Nifty 1D Rate Index

Rs. 5,000 per application and in multiples of Re. 1 thereafter. Units will be allotted in whole figures and the balance amount will be refunded.

Rs. 5000/- and in multiples of Re. 1/- thereafter.

Mirae Asset Capital Markets (India) Private Limited

Kanjolachana Finserve Private Limited

East India Securities Limited

Parwati Capital Market Private Limited

Cholamandalam Securities Limited

Click here to view

Click here to View

Click here to view the latest TER.

Recommended Investment Horizon

1 Day to 1 Week

Low

Savings

How to trade in ETF

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

*Data as on 31st May, 2022.

| Name | Allocation | |

| EXCHANGE TRADED FUNDS | ||

| 1 | Mirae Asset Mutual Fund | 100.20% |

100.01%

100.01%

(0.01)%

(0.01)%*Data as on 31st October, 2022.

Mirae Asset ETF is a part of Mirae Asset Mutual Fund and is used for Exchange Traded Funds managed by Mirae Asset Investment Managers (India) Private Limited.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.