Module 3 : Concepts of Investing

Diversification

Diversification

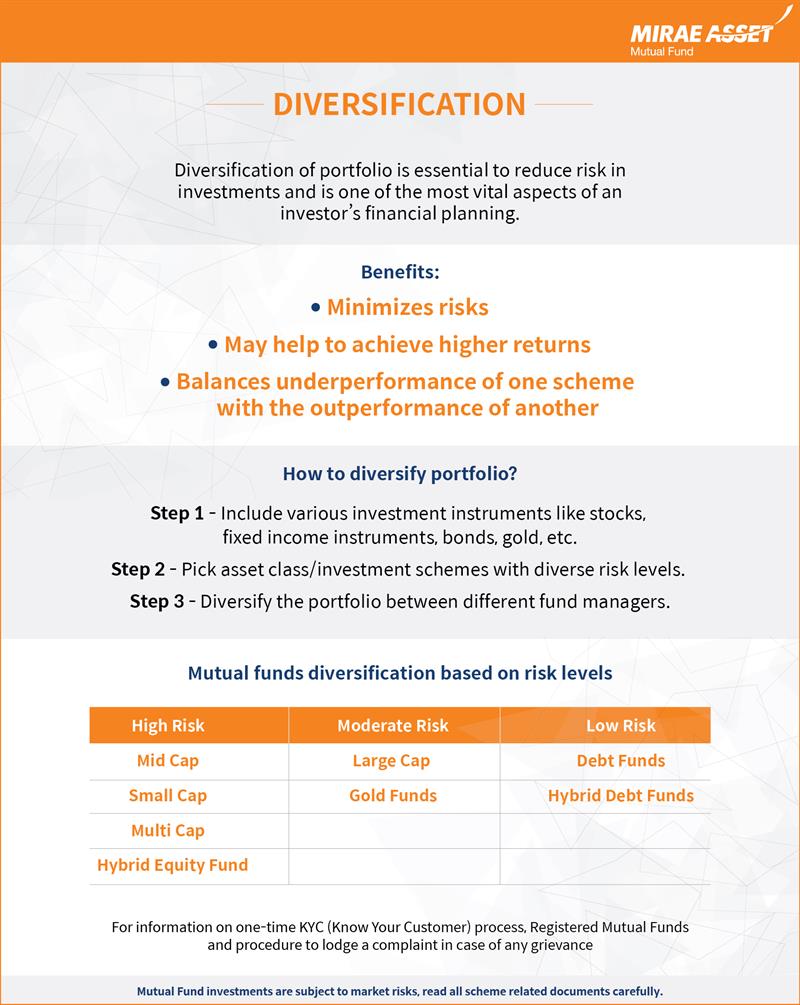

Diversification is one of the most frequently used words when it comes to investments. The aim of diversifying your investments is to minimize risks. By diversifying your mutual fund investments, you may achieve higher returns on an average. Diversification cushions the negative impact of the under-performance of any one scheme/ asset in your overall portfolio. To diversify mutual fund portfolio, you need to allocate across different scheme categories / asset classes. Diversification is essential to reduce risk in investments and is one of the most vital aspects of investor’s financial planning.

Why is the need to diversify?

Not only diversification is a method to reduce your overall portfolio risk, it also provides you with opportunities to invest in other assets/ categories that you may ignore otherwise. The idea of diversification is to not put all your eggs in one basket!

As a first step, an investor should diversify the portfolio by including various investment instruments like stocks, fixed income instruments, bonds, gold and so on.

And as the second step, the investor should diversify basis the risk profile of various asset class/ investment schemes. This can be done by picking asset class/ investment schemes with diverse risk levels. This helps in minimizing the risk as the loss in one asset gets compensated by the gains from the others. You can even think of diversifying across industry or sectors. In fact, if you are investing in mutual funds, you must diversify the portfolio between different fund managers as it is he/she who decides when and where to invest. Diversification is essential to risk reduction and is one of the most important aspects of financial planning.

How to Diversify Mutual Fund Portfolio?

Mutual funds can be the most preferred and easiest option to achieve diversification along with asset allocation for the investor without having in-depth knowledge of each asset class. By investing in mutual fund schemes that invest in different asset classes such as equity, debt and gold, you can spread your risks among various asset classes. This ensures that in case of an adverse economic situation, your investment value does not change drastically.

Let us see which mutual funds should investors target to diversify their investment?

Equity mutual funds: Equity mutual funds invest in the equity market. There are various kinds of equity funds, like large cap funds, mid cap funds and small cap funds. Large cap funds can be good for moderate risk taker, while mid cap funds can be ideal for moderately high risk takers and the small cap funds can be for the high risk takers. You can choose an option that suits your financial goals and risk appetite. You can even go for multi-cap funds which invest in all the three kinds of stocks, large, mid and small. While investing in these funds you can also analyse the scheme portfolios to ensure that the scheme/s you choose invests across various industries and companies.

Debt mutual funds: These funds invest in a mix of fixed income securities such as corporate bonds, money market instruments, Government Securities and treasury bills, etc. Debt funds has the potential to give higher returns compared to traditional investments like FDs. As the debt mutual funds are less risky than that of equity funds, it provides stability to your mutual fund portfolio.

Hybrid mutual funds: Hybrid mutual funds invest in equity as well as debt instruments. Hybrid funds are ideal for first time or risk averse investors who do not have the risk appetite to invest directly in equity mutual funds. These funds are the simplest way to diversify your investments in mutual funds.

Gold funds: You can invest in Gold with help of Gold Mutual Funds. Instead of buying physical gold and incur cost in its storage you can simply invest in Gold mutual funds in order to diversify your portfolio beyond equity and debt instruments.