Module 1 : Introduction to Mutual Funds

What is a Mutual Fund?

What is a Mutual Fund?

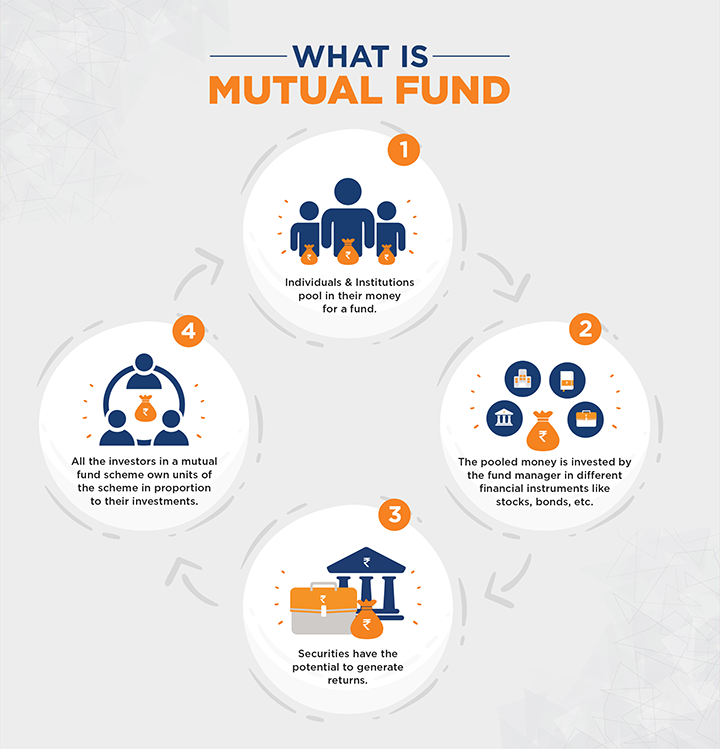

If you want to know what a mutual fund is, then note that it is an investment instrument through which an asset management company pools money from different individual and institutional investors that have common investment objectives. The pooled money is then invested by the fund manager in different financial instruments like stocks, bonds etc. as per the scheme mandate. All the investors in a mutual fund scheme own units of the scheme in proportion to their investments, which represents a portion of the total holdings of the said scheme.

What is mutual fund investment?

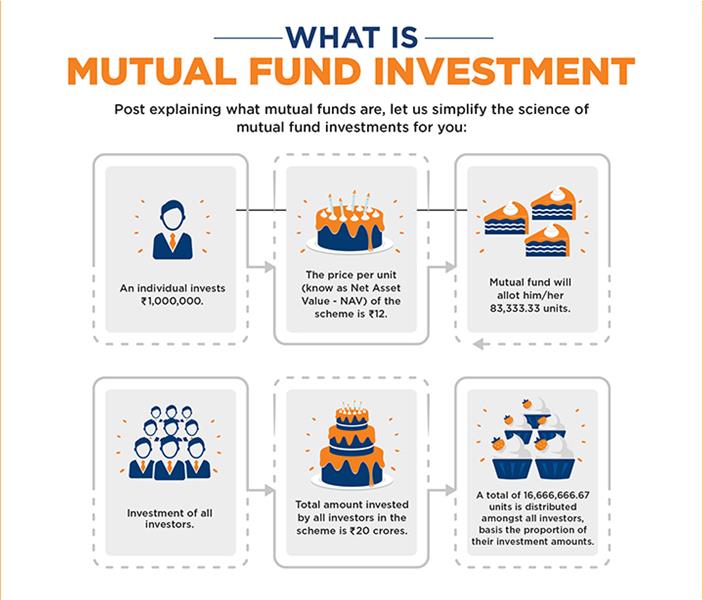

We can understand this better with the help of an example - Suppose you invested Rs 1,000,000 in a mutual fund scheme. If the per unit price (known as Net Asset Value - NAV) of the scheme is Rs 12, then the mutual fund house will allot you 83,333.33 units (Rs 10,00,000 / NAV of Rs 12, subject to deduction of applicable stamp duty). Let us assume the total money invested in the fund by all the investors is Rs 20 Crores, therefore, the scheme will issue in total 16,666,666.67 units amongst its entire investors basis the proportion of their investment amounts, subject to deduction of applicable stamp duty. Please note that each unit will have exposure to all the securities that the fund manager has bought in the portfolio.

NAV is the price at which investors can buy or sell the mutual fund scheme. The NAV of a mutual fund scheme is calculated by deducting the total liabilities from the assets in the portfolio, divided by total number of units. Mutual fund unit are bought and sold at the prevailing NAVs.

When investing in mutual funds, you need not worry about managing the investments and its diversification as the fund manager invests across sectors and companies through different investment instruments.

Some common mutual fund categories are as follows –

Equity funds – Equity funds invest in listed equity share and other equity oriented instruments.

Debt Funds – Debt funds invest in fixed income instruments like treasury bills, commercial papers, certificates of deposit, corporate bonds and government bonds.

Hybrid Funds – Hybrid funds invest both in equity and fixed income instruments. The proportion of equity and debt investment depends on type/ category of scheme.

ELSS Funds – ELSS funds are essentially equity funds. One can save taxes under Section 80C of The Income Tax Act 1961 by investing up to Rs 150,000 in a year in these funds (being the present limit).