Module 4 : How to Start MF Investments

Importance of an Independent Financial Advisor

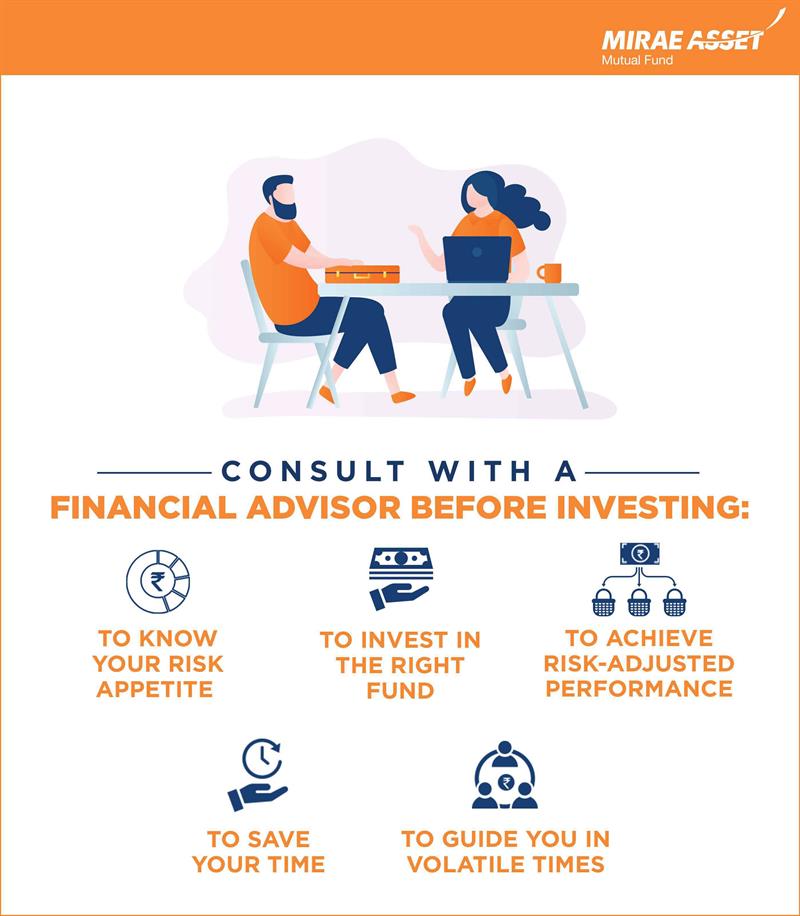

There are several reasons why you should consult with a financial advisor before investing.

- Know your risk appetite: You should always take the right amount of risk, not less and not more. If you take less risk, you will get low returns. If you take too much risk, you may lose your money. It is important to know your risk appetite. Risk appetite may seem very subjective, but a good independent financial advisor will help you identify your risk appetite objectively based on investment goals, stage of life, income, expenses, assets, liabilities etc.

Importance of an Independent Financial Advisor

There are several reasons why you should consult with a financial advisor before investing.

- Know your risk appetite: You should always take the right amount of risk, not less and not more. If you take less risk, you will get low returns. If you take too much risk, you may lose your money. It is important to know your risk appetite. Risk appetite may seem very subjective, but a good independent financial advisor will help you identify your risk appetite objectively based on investment goals, stage of life, income, expenses, assets, liabilities etc.

- Invest in the right fund: Different fund have different risk profiles. A financial advisor will help you invest in the right fund that is best suited for your specific investment needs. Investing in the wrong fund can be harmful for your financial interests. An independent financial advisor has the requisite expertise in helping you select the right products.

- Invest in funds which can give you risk adjusted performance: Investors often select funds based on recent performance. A fund’s recent performance is subject to a number of factors e.g. market conditions, fund manager’s strategy in given market condition etc. You should always look at the long term track record of the fund manager across different market conditions. An independent financial advisor can help you in this regard.

- Save your time: Managing a mutual fund portfolio can be time consuming especially if you are not familiar / comfortable with online transactions. In addition to making transactions, you also need to research schemes, monitor your portfolio performance on an ongoing basis and take corrective actions, if required. Your independent financial advisor will make fund recommendations and review your portfolio performance on a regular basis, thus you can manage your portfolio more efficiently.

Help you remain disciplined in difficult times: Stock markets are volatile and your investment journey may not always be smooth. In difficult times, investors often make wrong investment decisions purely out of emotional reaction. Your independent financial advisor can be a good friend in difficult times helping you remain calm and disciplined which will have important consequences in achieving success in your long term financial goals.