Module 4 : How to Start MF Investments

How to Invest Online - Documents required

How to Invest Online - Documents required

Before you start investing in mutual funds online, you need to ensure that you are mutual fund KYC complaint. As a new investor, you must know the documents required to invest online in mutual funds.

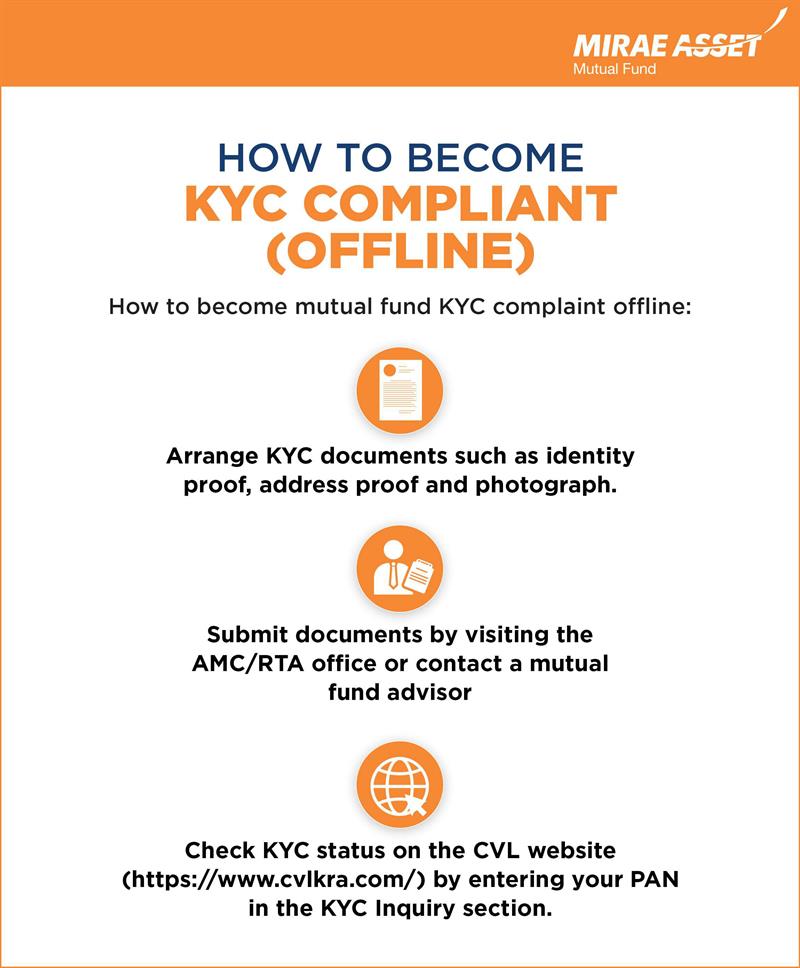

As a first step, you need to submit your KYC documents i.e. identity proof, address proof and photograph to the AMC or RTA. This can be done either online or offline (by visiting the AMC / RTA office or contacting a mutual fund advisor). You can also check your KYC status on CVL website (https://www.cvlkra.com/) by entering your PAN in the KYC Inquiry section ((in case you have forgotten if you have a mutual fund KYC). There are 4 ways in which you can invest online in mutual funds.

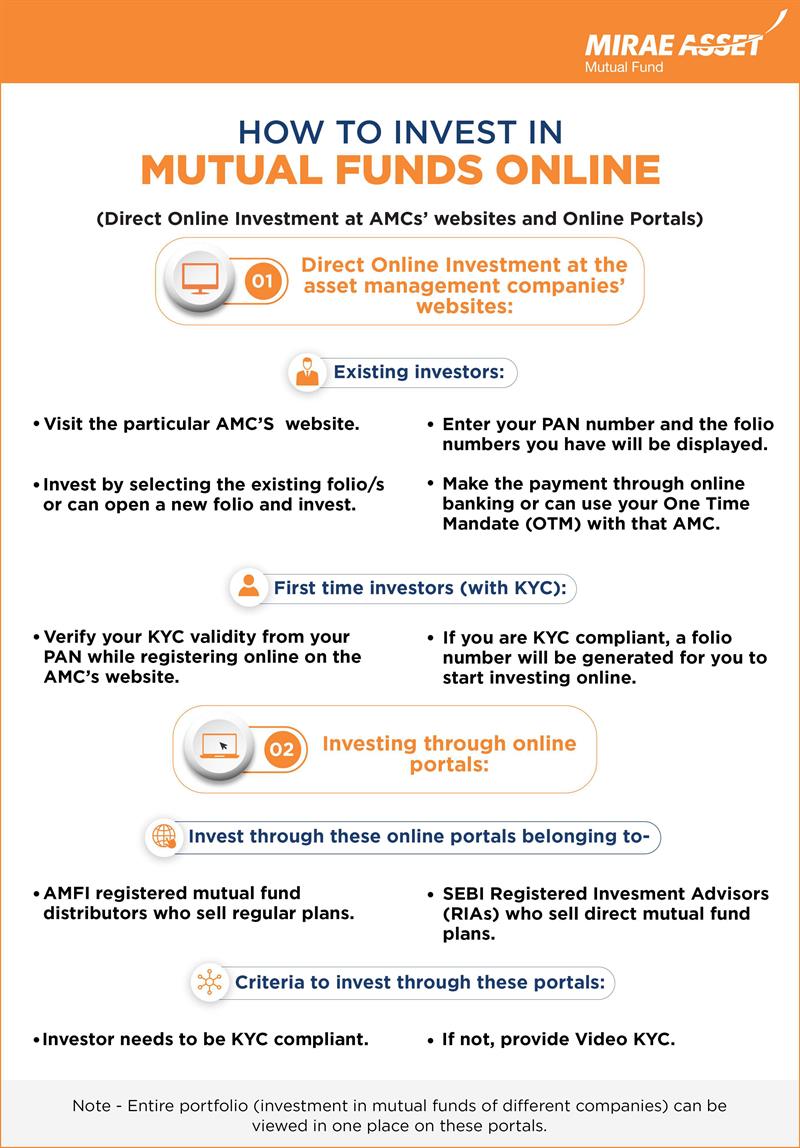

Direct Online Investment at the asset management companies’ websites:

If you are an existing investor of a particular asset management company you can start investing online by visiting the asset management company (AMC) website. You can enter your PAN number and the company will display the folio numbers you have. You can invest selecting the existing folio/s or can open a new folio and invest. While investing, you can make the payment through online banking or can use the OTM (one time mandate), if you have any with that AMC.

If you are a first time investor of a particular mutual fund company with a valid KYC, the new mutual fund company will first check for the KYC validity from your PAN when you register online. If they find that you are KYC compliant, then they will generate a folio number for you and you can start investing online.

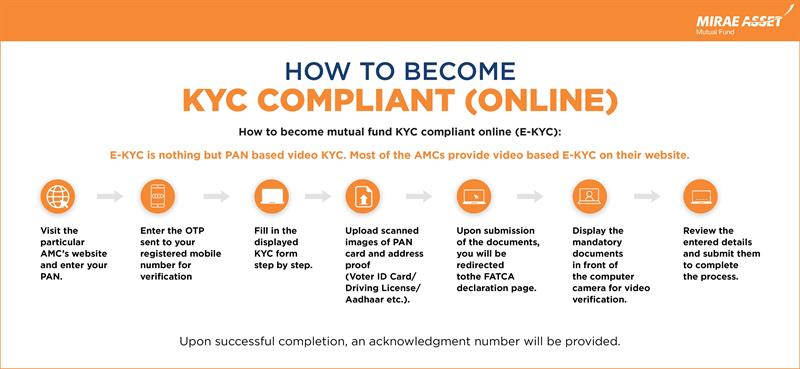

If you do not have a valid KYC, you need to submit the KYC documents to the asset management company. Alternatively, new investors who do not have a mutual fund KYC can complete the process online through E-KYC. E-KYC is nothing but PAN based Video KYC. Most of the AMCs provide Video based E-KYC on their website. Once you input your PAN number, an OTP is sent to your registered mobile number for verification. A KYC form is then displayed and you have to fill in the details step by step. You need to upload scanned images of PAN Card and address proof (Voter ID Card/ Driving License/Aadhaar/ Any Govt. ID proof, etc.). Upon submission of the documents, the user is taken to the FATCA declaration page. Next is video verification of your documents where the investor has to display the mandatory documents in front of the computer camera. At the end, you can review the entered details and submit to complete the process. Upon successful submission an acknowledgment number is provided.

Investing through online portals:

There are several online portals through which you can invest in mutual funds. These online portals either belong to AMFI registered mutual fund distributors who sell regular plans or SEBI registered Investment Advisors (RIAs) who sell direct mutual fund plans. To invest through the online portals your KYC has to be registered. However, if you do not have a KYC, these platforms may provide you Video KYC as per the process explained above. One of the advantages of investing through an online portal is that you can view your entire portfolio (investment in mutual funds of different companies) in one place.

Investing through your online demat account:

Some brokers who provide online trading and demat services, also offer online investment in mutual funds. Mutual funds bought through your broker are held in your demat account. Investors should note that to invest in Exchange Traded Funds (ETFs) an online trading and demat account is mandatory.

Investing through registrar and transfer agents (RTAs):

RTAs also offer online mutual fund investment if you have a valid KYC. However, you cannot invest in all mutual fund companies through the RTAs – CAMS, Karvy and FT. Investing online through RTAs offers you the benefit of portfolio viewing in one place provided all your investments are in AMCs for whom the RTA provides the register and transfer services.