Module 1 : Introduction to Mutual Funds

How do Mutual Funds Work?

We have learned what a mutual fund investment is. Let us now learn how does a mutual fund work.

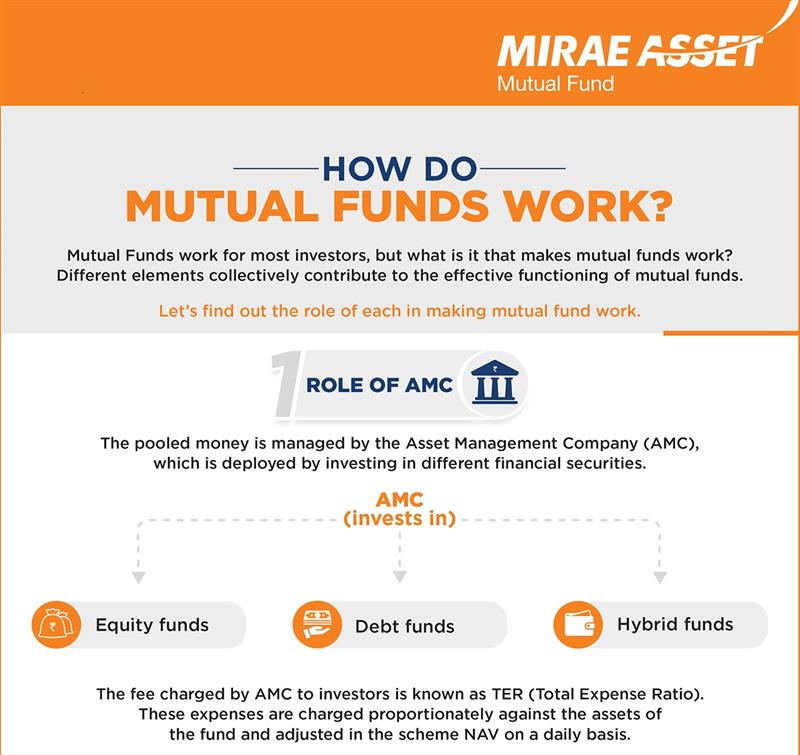

The Money pooled from different individual and institutional investors is managed by the Asset Management Company (AMC). The AMC then deploys the money by investing in different financial securities like shares of listed companies, bonds, Government Securities etc. as per the scheme type and objective as mentioned in the Scheme Information Document (SID). For example – An equity fund will predominantly invest in a portfolio of listed shares whereas a debt mutual fund scheme will invest in bonds, Government Securities and money market instruments depending upon the fund type. Likewise, a hybrid fund can invest both in equities as well as debt instruments.

How do Mutual Funds Work?

We have learned what a mutual fund investment is. Let us now learn how does a mutual fund work.

The Money pooled from different individual and institutional investors is managed by the Asset Management Company (AMC). The AMC then deploys the money by investing in different financial securities like shares of listed companies, bonds, Government Securities etc. as per the scheme type and objective as mentioned in the Scheme Information Document (SID). For example – An equity fund will predominantly invest in a portfolio of listed shares whereas a debt mutual fund scheme will invest in bonds, Government Securities and money market instruments depending upon the fund type. Likewise, a hybrid fund can invest both in equities as well as debt instruments.

Further, within the asset class, the investment objectives can be narrowed down further. For example – within equity funds, there can be mid cap, large cap, small cap or focused funds. Similarly in debt funds, there are funds in which you can invest for few days to funds in which you can remain invested for many years. Depending upon the fund type and scheme objective, the fund manager selects the stocks or debt instruments as the case maybe.

On an on-going basis, the fund managers manage the fund and decide when and what securities to buy and sell to ensure that the investment objectives are met. For the services that the AMC provide, they incur expenses and charge a fee to the unit holders. This fee is known as TER (Total expense ratio). These expenses are charged proportionately against the assets of the fund and are adjusted in the scheme NAV on a daily basis. Please note that there can be more than one fund manager for managing one scheme.

Mutual funds are bought and sold on the basis of Net Asset Value (NAV). Unlike shares, the prices of which change constantly depending on the activity in the share market, the NAV is determined on a daily basis, computed at the end of the day based on the closing price of the respective securities that the mutual fund holds in the scheme portfolio after making appropriate adjustments.

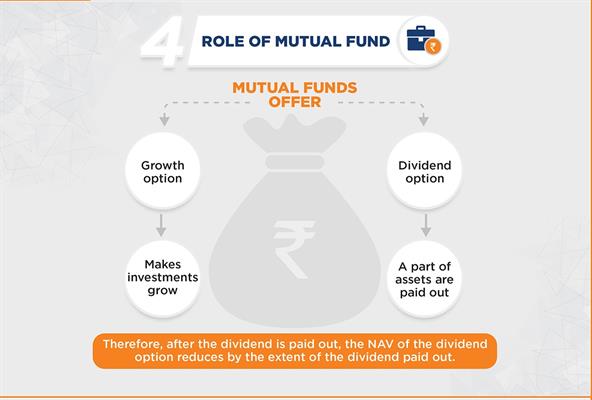

Mostly, the mutual funds offer two options to invest - growth and dividend. The AMC may declare dividends in dividend option while no dividend is declared in the growth option. Therefore, in the growth option your investments may keep growing while in the dividend option, through dividends a part of the assets is paid out. Therefore, after the dividend is paid out, the NAV of the dividend option reduces by the extent of the dividend paid out.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here! Information on KYC, Registered Intermediaries and Grievance Redressal

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.