Module 2 : Type Of Mutual Funds

Types of Hybrid Mutual Funds?

Types of Hybrid Mutual Funds?

What are Hybrid funds?

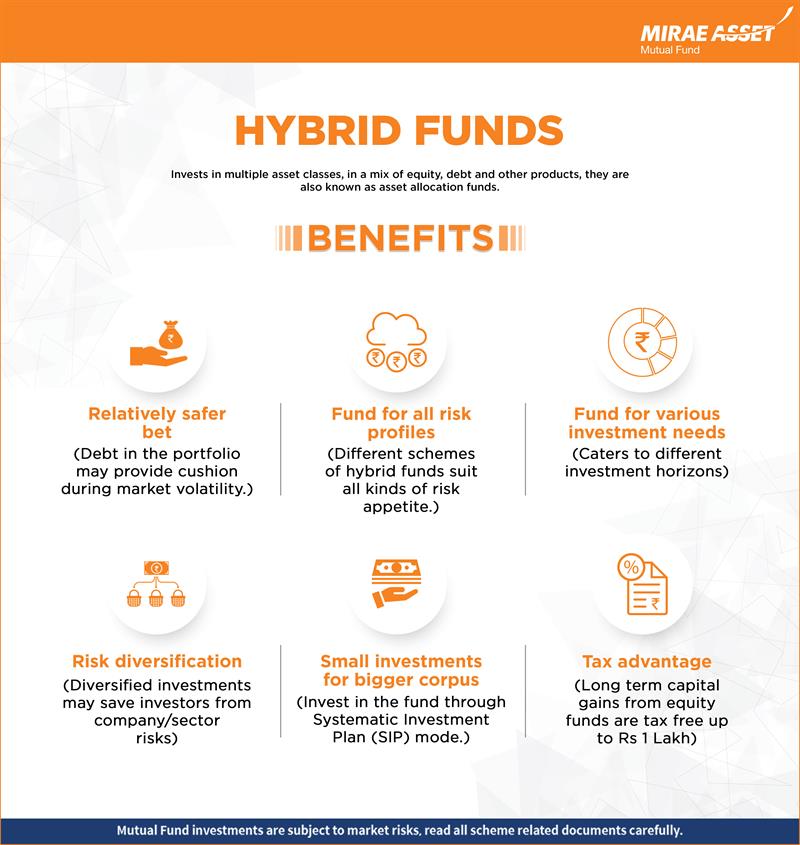

Hybrid funds are mutual fund schemes that are characterized by diversification within two or more asset classes e.g. equity, fixed income, gold etc. Hybrid funds, also known as asset allocation funds, offer investors exposure to multiple asset classes and risk diversification thereof through a single investment. There are several types of hybrid funds with varying risk levels ranging from conservative to moderately aggressive.

Features and Benefits

- Hybrid mutual funds offer asset allocation benefits. Through asset allocation investors can balance risk and return, i.e. provide investors opportunity to get optimum returns while limiting volatility. A number of studies have proven that asset allocation can be one of the effective ways of achieving financial goals.

- The equity component of hybrid funds can generate higher potential returns in the long term through the equity component while the debt component aims to provide stability and reduce volatility.

- Hybrid funds provide automatic rebalancing of assets. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation despite market movements. Portfolio rebalancing is important since it reduces risk and also enables investors to aim for superior risk adjusted returns.

- Since hybrid funds invest in low volatility asset classes e.g. debt, gold etc in addition to equity, they are less volatile compared to pure equity funds and as such, are suitable for first time investors.

- Hybrid funds enjoy tax advantage. Funds which have 65% equity component in its portfolio are taxed as equity funds and those with less than 65% equity component are taxed as debt funds. Long term (investments held for greater than 1 year) capital gains from equity oriented hybrid funds are tax free up to Rs 1 Lakh in a financial year. Long term capital gain over Rs 1 Lakh is taxed at 10%. Short term (investments held for less than 1 year) capital gains are taxed at 15% for equity oriented hybrid funds.

Long term (investments held for more than 3 years) capital gains from debt oriented hybrid funds are taxed at 20% after allowing indexation. Short term (investments held for less than 3 years) capital gains are clubbed with investors total income and taxed according to the slab applicable.

While conservative hybrid funds are definitely taxed as debt funds, some other hybrid funds e.g. dynamic asset allocation funds, multi asset funds, which have the flexibility of investing more than 35% in debt can also be taxed as debt funds depending on their average asset allocations. You should consult with your mutual fund distributor or financial advisor regarding the tax treatment of hybrid schemes before investing.

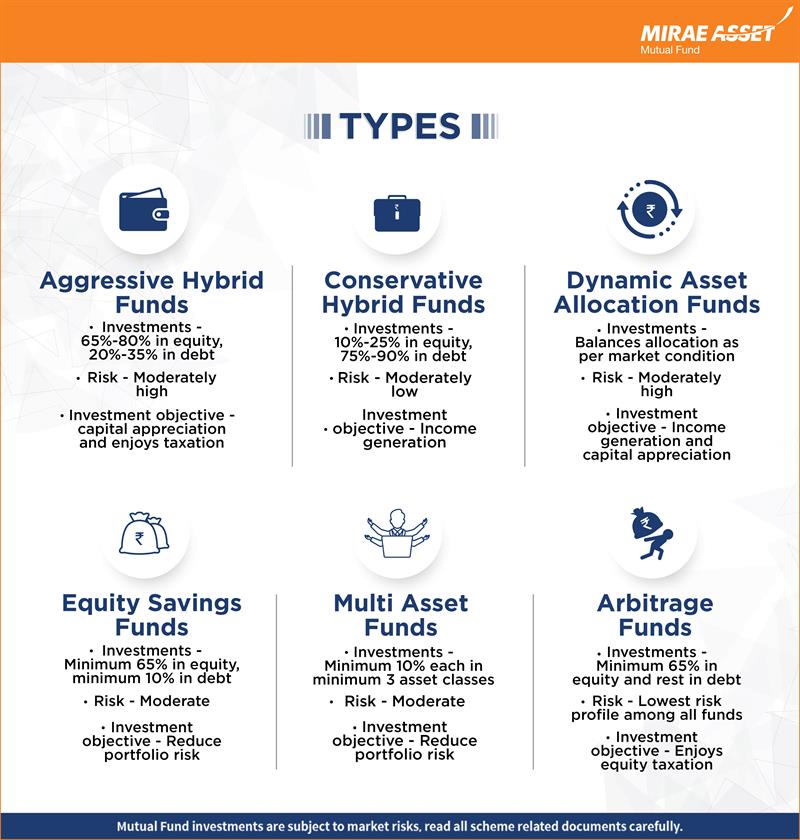

Hybrid Fund Categories

Hybrid mutual funds offer various types of funds suiting investors risk profile, investment time horizon and financial goals. Investors with lower risk appetites can invest in funds with debt allocations, while those with higher risk appetite can invest in funds with higher equity allocations. According to SEBI, there are six hybrid fund categories according to their asset allocation mandates (please see the table below).

| Category | Asset Allocation | Risk Profile | Investment horizon | Taxation | ||

|---|---|---|---|---|---|---|

| Equity (incl. arbitrage) | Debt | Gold, etc | ||||

|

Aggressive Hybrid* |

65 – 80% |

20 – 35% |

- |

Moderately high |

5+ years |

Equity taxation |

|

Balanced Hybrid* |

50% |

50% |

- |

Moderately high |

5+ years |

Check with your advisor |

|

Conservative Hybrid |

10 – 25% |

75 – 90% |

- |

Moderate |

3+ years |

Debt taxation |

|

Dynamic Asset Allocation |

Dynamic |

Dynamic |

- |

Moderately high |

4 – 5 years |

Check with your advisor |

|

Equity Savings |

Minimum 65% (partially hedged - arbitrage) |

Minimum 10% |

- |

Moderately high |

3+ years |

Equity taxation |

|

Multi Asset |

Minimum 10% |

Minimum 10% |

Minimum 10% |

Moderately high |

4 – 5 years |

Check with your advisor |

|

Arbitrage fund |

Minimum 65% (completely hedged - arbitrage) |

Maximum 35% |

- |

Low |

Few weeks, months, up to 1 year |

Equity taxation |

* Mutual Funds are permitted to offer either an aggressive hybrid fund or balanced Fund